Transact

Everything to open and manage your account.

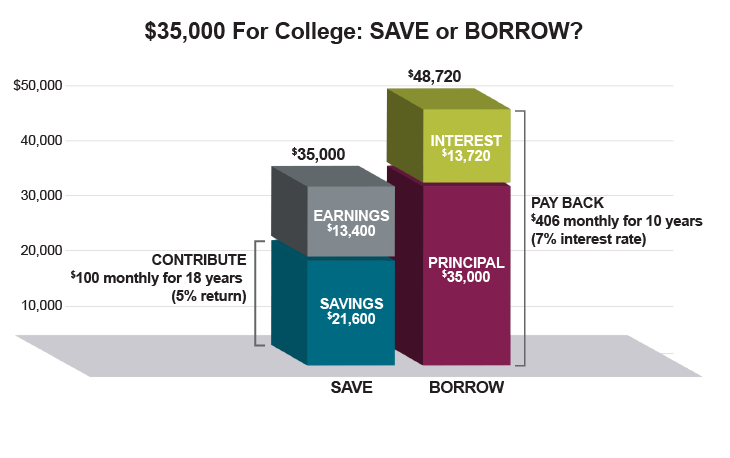

A dollar isn’t a dollar when it comes in the form of a student loan. That’s because every dollar you borrow will eventually have to be paid back with interest.

Saving, on the other hand, beats borrowing every time. When you save, you have the potential to earn money on your contributions (called a “return”), and even money on your return (called “compounding”). That's why even small contributions every month can make a big difference when it’s time to start college.

Consider these hypothetical scenarios:

Akamai's parents start investing $100 a month into a HI529 plan account right after Akamai's birth. In 18 years (assuming a 5% annual rate of return), they could potentially save more than $35,000.2

After exhausting federal student aid options, Akamai has to borrow $35,000 to attend college. Based on a private student loan rate of 7.0 percent, Akamai could be faced with a monthly payment of $406 for 10 years (or $48,720).3

Don't wait any longer — open a HI529 account today.

1A plan of regular investment cannot ensure a profit or protect against a loss in a declining market.

2This hypothetical example is for illustrative purposes only and assumes no withdrawals made during the period shown. It does not represent an actual investment in any particular 529 plan and does not reflect the effect of fees and expenses. Your actual investment return may be higher or lower than that shown. The loan repayment terms are also hypothetical.