Transact

Everything to open and manage your account.

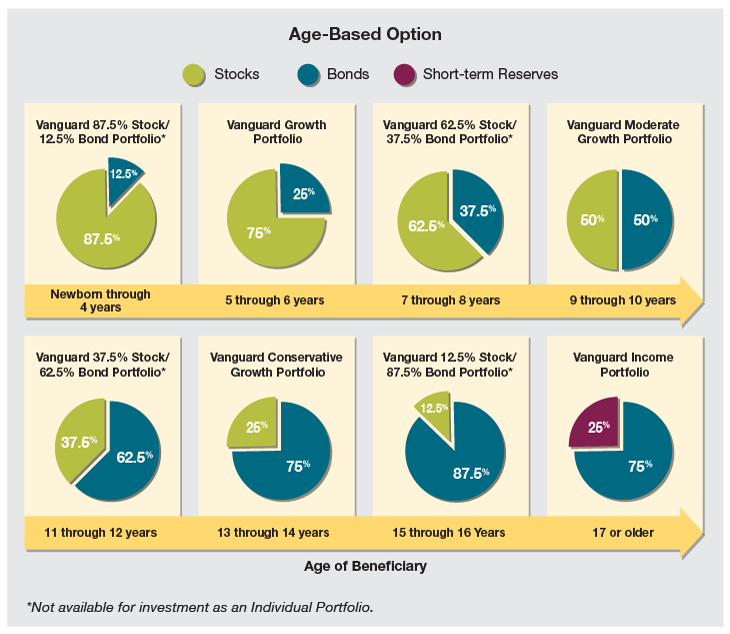

When your child is younger, you may opt for more aggressive investments – and the potential growth that comes with them. Later, as your child approaches college age, you may choose to take a more conservative approach that values preservation over growth.

The HI529 Age-Based Option does exactly this. As your child ages, these portfolios automatically shift from mutual funds with higher stock concentrations to those heavier in bond and short-term reserves.

The goal: keep more of what you’ve earned when you need it most.

Note: Portfolios with higher allocations to bonds and short-term investments tend to be less volatile than those with higher stock allocations. Less volatile portfolios generally may not decline in value as much when markets decline, but also may not appreciate in value as much when markets go up. Investments in bonds are subject to interest rate, credit, income, and inflation risk.

Account Owners assume all investment risks as well as responsibility for any federal and state tax consequences.